godtradingstrategies.site

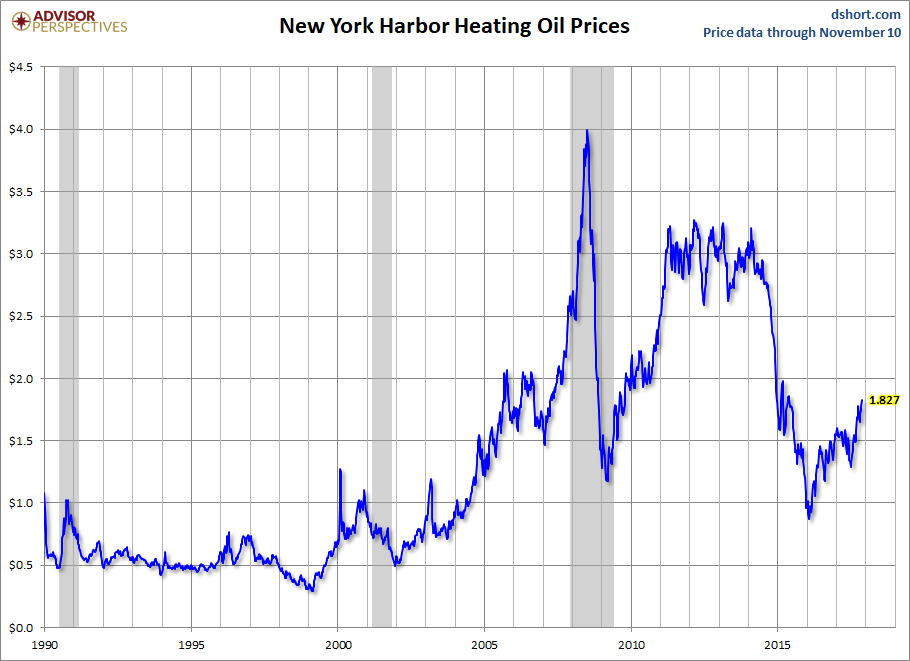

Prices

Nymex Heating Oil Price Today

Today's Heating Oil prices with latest Heating Oil charts, news and Heating Oil futures quotes. Heating Oil (Nymex). USd/gal. , +, +%, Oct , PM. Precious Oil Price Rout Drives Russian Revenues to Seven-Month Low. 9/9/ Get the latest Heating Oil price (HO:NMX) as well as the latest futures prices and other commodity market news at Nasdaq. The Dashboard includes current and historical residential retail price data, regional comparison, and fuel type comparisons for heating oil, kerosene, and. Heating Oil Oct 24 (HO=F) ; May 28, , , , , ; May 24, , , , , The Heating Oil Futures Contract is cash settled against the prevailing market price for Heating Oil in New York Harbor. NYMEX for the month of. Access the deep liquidity of our Heating Oil products, with futures trading over million barrels every day on NYMEX. Heating Oil's average daily volume. Price information Fuel oil NYMEX ; Closing price prev trading day ; Day range, / ; 52 week range, /. Today's Range: - 52 Week Range: - Expiration: 29/09 Oil prices ease 1% after US Fed warns of higher rates for longer. September. Today's Heating Oil prices with latest Heating Oil charts, news and Heating Oil futures quotes. Heating Oil (Nymex). USd/gal. , +, +%, Oct , PM. Precious Oil Price Rout Drives Russian Revenues to Seven-Month Low. 9/9/ Get the latest Heating Oil price (HO:NMX) as well as the latest futures prices and other commodity market news at Nasdaq. The Dashboard includes current and historical residential retail price data, regional comparison, and fuel type comparisons for heating oil, kerosene, and. Heating Oil Oct 24 (HO=F) ; May 28, , , , , ; May 24, , , , , The Heating Oil Futures Contract is cash settled against the prevailing market price for Heating Oil in New York Harbor. NYMEX for the month of. Access the deep liquidity of our Heating Oil products, with futures trading over million barrels every day on NYMEX. Heating Oil's average daily volume. Price information Fuel oil NYMEX ; Closing price prev trading day ; Day range, / ; 52 week range, /. Today's Range: - 52 Week Range: - Expiration: 29/09 Oil prices ease 1% after US Fed warns of higher rates for longer. September.

Crude oil prices & gas price charts. Oil price charts for Brent Crude, WTI & oil futures. Energy news covering oil, petroleum, natural gas and investment. New York Harbor No. 2 Heating Oil Spot Price FOB (Dollars per Gallon). Week Of, Mon, Tue, Wed, Thu, Fri. Jun- 2 to Jun- 6, , , , The current price of WTI crude oil as of September 10, is $ per barrel. Historical Chart; 10 Year Daily Chart; By Year; By President; By Fed. NYMEX, % Fuel Oil Cargoes FOB MED (Platts) Crack Spread BALMO Futures, Future, Certified, 03/08/ ; NYMEX, NYMEX Heating Oil Minute-Marker Futures, Future. Commodity Futures Price Quotes For Heating Oil (NYMEX) (Price quotes for NYMEX Heating Oil delayed at least 10 minutes as per exchange requirements). Crude Oil is expected to trade at USD/BBL by the end of this quarter, according to Trading Economics global macro models and analysts expectations. Contract Specifications · Trading Unit Futures: 42, U.S. gallons (1, barrels). · Price Quotation Heating Oil Futures and Options: In dollars and cents per. ULSD Heating Oil (Oct'24) @HONew York Mercantile Exchange ; Open ; Day High ; Day Low ; Prev Close ; 10 Day Average Volume58, Sell dec heating oil on stopSell dec heating oil on stop It is a pending order. Trade confirmed. NYMEX:HO1! Short. by Cannon-Trading. Updated. Prices - CME heating oil futures prices (godtradingstrategies.site symbol code HO) on the nearest-futures chart in opened at $ per gallon, moved lower into June. Gain instant access to the live Heating Oil price, key market metrics, trading details, and intricate Heating Oil futures contract specifications. Heating oil futures in the US dropped to around $ per gallon in September, reaching their lowest level since November amid a broader oil market. Heating Oil (Globex) (NYMEX) ; Trading Unit: 42, U.S. gallons (1, barrels) ; Tick Size: $ (c) per gallon ($ per contract) ; Quoted Units: US $. View the latest Heating Oil (NYM $/gal) Front Month Stock (HO.1) stock price, news, historical charts, analyst ratings and financial information from WSJ. Futures Overview ; Crude Oil Continuous Contract, $, ; Brent Crude Oil Continuous Contract, $, ; Natural Gas Continuous Contract, $, -. Find the latest Heating Oil Oct 24 (HO=F) stock quote, history, news and other vital information to help you with your stock trading and investing. NYMEX Crude Oil Front Month · Price (USD) · Today's Change / % · Shares tradedk · 1 Year change% · 52 week range - The cash settlement price is an amount equal to the settlement price on the penultimate day of trading of the NYMEX New York Harbor Gasoline Blendstock (RBOB). Get updated data about energy and oil prices. Find natural gas, emissions, and crude oil price changes Heating Oil (Nymex). USd/gal. , , %. Tier 3: If there is no last trade price available, then the prior settle is checked against the current bid/ask. 1. If the prior settle is outside of the bid/.

Crypto Future Reddit

It's not too late to invest in crypto in , as future cycles and potential bull markets are expected. Consider using Net coins Crypto. What are some cryptocurrencies I can invest in that have good/great potential for the future. I plan on holding these for the next years as I'd. Cryptocurrency got a big future for sure. Recommend Freewallet app for storing it as they support a lot of units. Crypto currencies will never be widely adopted by businesses because the governments will put regulations on it or outright bans which has. ” Now, Ethereum is poised to become even more integral to the decentralized future. crypto card, the godtradingstrategies.site Exchange and godtradingstrategies.site DeFi Wallet. Personally I would like to see the more open blockchain nature become more widespread in traditional finance. More of an open ledger. The investment in cryptocurrency will be the future trend, and I believe it will be the best investment in this era, just like the stocks and. I want to invest in projects that has a future and the tokenomics to back that. I understand that some of you finds my post strange and want one. r/CryptoFutures: The community to get you started with crypto futures! It's not too late to invest in crypto in , as future cycles and potential bull markets are expected. Consider using Net coins Crypto. What are some cryptocurrencies I can invest in that have good/great potential for the future. I plan on holding these for the next years as I'd. Cryptocurrency got a big future for sure. Recommend Freewallet app for storing it as they support a lot of units. Crypto currencies will never be widely adopted by businesses because the governments will put regulations on it or outright bans which has. ” Now, Ethereum is poised to become even more integral to the decentralized future. crypto card, the godtradingstrategies.site Exchange and godtradingstrategies.site DeFi Wallet. Personally I would like to see the more open blockchain nature become more widespread in traditional finance. More of an open ledger. The investment in cryptocurrency will be the future trend, and I believe it will be the best investment in this era, just like the stocks and. I want to invest in projects that has a future and the tokenomics to back that. I understand that some of you finds my post strange and want one. r/CryptoFutures: The community to get you started with crypto futures!

Considering the upcoming Bitcoin halving cycle in , diversifying your portfolio with a mix of established cryptos like ALGO, HBAR, QNT is a. The crypto market will have its own cycle where people leave and think it's dead, then 3 years later more (younger) people will show up and think they just. crypto #Bitcoin #exchange #blockchain. DISCUSSION. Upvote 3. Downvote 14 There will be a live Q&A session today on the upcoming deadline and how to. Are there some community on reddit that influenced the crypto with low capitalization and manipulate the market? What is its name? Crypto futures are insanely manipulated, they keep doing it because there is no regulatory body overseeing the market. So they have no problem. To you profitable futures traders, what resources do you recommend to learn? Where/how do you recommend I refine my technique? 6 months into Crypto and I lost all my money from 4 days of Future trading! reddit. Upvote 1. Downvote Reply reply. Share. Crypto futures is absolutely, %, unequivocally harder than stock trading. I trade both, more swing trading with crypto and more intraday with. r/crypto · Crypto is not cryptocurrency · [Meta] Regarding the future of the subreddit. I'd like to see a global currency that had the tech of ethereum but the portability of bitcoin and could handle the high levels of transactions. I've been pondering the potential growth of the crypto market, currently at $1 trillion compared to the stock market's $50 trillion cap. I would like to have a discussion about whether or not you see a future for crypto in your investment portfolio. I'm not talking day trading or shorting. Trading Crypto futures in terms of the best, safest strategy, is to scalp trade using no more than 10x leverage, ensuring you close your trade within hours. r/CryptoMarkets: A community for news and discussion about cryptocurrency finance. I'm pretty sure in years, the future of crypto will be so advanced that we'll all be paying for our flying cars and space vacations with Dogecoin. r/CryptoCurrency: The leading community for cryptocurrency news, discussion, and analysis. DCA monthly long before I joined Reddit but seeing the price of all my chosen bags get lower each month I can't help but wonder about holding. My guess is that they don't plan on investing more on this platform and have decided to cede the market to crypto-native companies. Also, reddit will be a deserted hell hole of AI bot chatter and it will be next to impossible to spot the minority of actual people writing. To whoever who says " past performance is not indicative of future performance ": Can you analyze a new chart(with 0 data) and spot support and resistance and.

Financial Planning Applications

Money Manager - the #1 financial planning, review, expense tracking, and personal asset management app for Android! Money Manager makes managing personal. Now accepting applications for the Robert J. Glovsky Scholarship - scroll down for details! As concern for financial security has grown, individuals have. Find the top Financial Planning Software with Gartner. Compare and filter by verified product reviews and choose the software that's right for your. 1 Finance: Financial Advisory. 1 Finance is an app where you can connect with a financial planner and receive advice on almost every aspect of. Xplan is the complete financial planning and wealth management software for advisers. Enjoy professional advice tools and an integrated CRM & back office. While its offerings may be too comprehensive for users looking for more simple financial planning tools or budgeting apps, Money Tree does not offer mobile. Quicken Simplifi is an all-in-one financial management tool that helps you with everything from budgeting and meeting financial goals to saving for retirement. Financial advice delivery – reimagined. Modernizing how financial institutions deliver advice across all their customer segments. Business financial planning tools are software applications that help businesses plan, track and manage their finances. These tools provide powerful. Money Manager - the #1 financial planning, review, expense tracking, and personal asset management app for Android! Money Manager makes managing personal. Now accepting applications for the Robert J. Glovsky Scholarship - scroll down for details! As concern for financial security has grown, individuals have. Find the top Financial Planning Software with Gartner. Compare and filter by verified product reviews and choose the software that's right for your. 1 Finance: Financial Advisory. 1 Finance is an app where you can connect with a financial planner and receive advice on almost every aspect of. Xplan is the complete financial planning and wealth management software for advisers. Enjoy professional advice tools and an integrated CRM & back office. While its offerings may be too comprehensive for users looking for more simple financial planning tools or budgeting apps, Money Tree does not offer mobile. Quicken Simplifi is an all-in-one financial management tool that helps you with everything from budgeting and meeting financial goals to saving for retirement. Financial advice delivery – reimagined. Modernizing how financial institutions deliver advice across all their customer segments. Business financial planning tools are software applications that help businesses plan, track and manage their finances. These tools provide powerful.

These processes include planning, budgeting, forecasting, scenario modeling, and performance reporting. FP&A is not merely accounting, but accounting is. Retirement Planning #, 3. FIN , Financial Planning Technology and Modeling #, 3. FIN , Financial Planning Applications #, 3. MGT , Foundations of. Financial Planning, Budgeting and Forecasting Solutions · People Planning Software · Sales Planning & Operations · Capital Planning · Predictive Analytics Research also shows that planning supports sound money habits as well. Americans who have a financial plan also have healthy money habits. Sixty-five percent of. What Are The Best Financial Planning Apps? · 1. Mint · 2. YNAB (You Need A Budget) · 3. Personal Capital · 4. PocketGuard · 5. Quicken · 6. Harmonize your planning data across SAP and third-party sources with the SAP Datasphere solution · Deliver plans natively integrated with your SAP application. I couldn't be happier with the work you are doing. Stephen Hazel. Magnificent Life Financial Planning. Vanguard is a company of tremendous resources, and for that reason can offer premium retirement planning tools free of charge. Vanguard boasts one of the best. Despite the availability of enterprise-wide planning and budgeting software, many finance professionals still make use of spreadsheets. But financial. We introduce the most easy to use Financial Planner, a handy management application for your incomes/expenses. The brilliant idea and purpose of this app is to. Take the guesswork out of planning for retirement. WealthTrace gives the most accurate financial projections and allows you to monitor your investment holdings. Our financial advisors help you with your personal finance and guide you in Tax Planning The following data may be used to track you across apps and websites. Xplan is the complete financial planning and wealth management software for advisers. Enjoy professional advice tools and an integrated CRM & back office. Top financial planning apps or resources: Mint Mint is a popular financial planning app that is free of charge. Financial advice delivery – reimagined. Modernizing how financial institutions deliver advice across all their customer segments. There are free budgeting apps there like Money Dashboard to do this expense tracking for you. If you are ok with paying: Nova Money. They. Walnut is one of the top financial planning apps that lets you track your expenses and makes money management a cakewalk. Key Features. Allows users to manage. Personal Financial Planning: Cases and Applications [James Dalton] on godtradingstrategies.site *FREE* shipping on qualifying offers. Personal Financial Planning: Cases. Master every aspect of your financial life with expert advice and how-to guides on topics ranging from investing and debt management to finding a new job. Discover financial education programs that can advance your career in any facet of financial services. Enroll today and become CFFP's next successful.

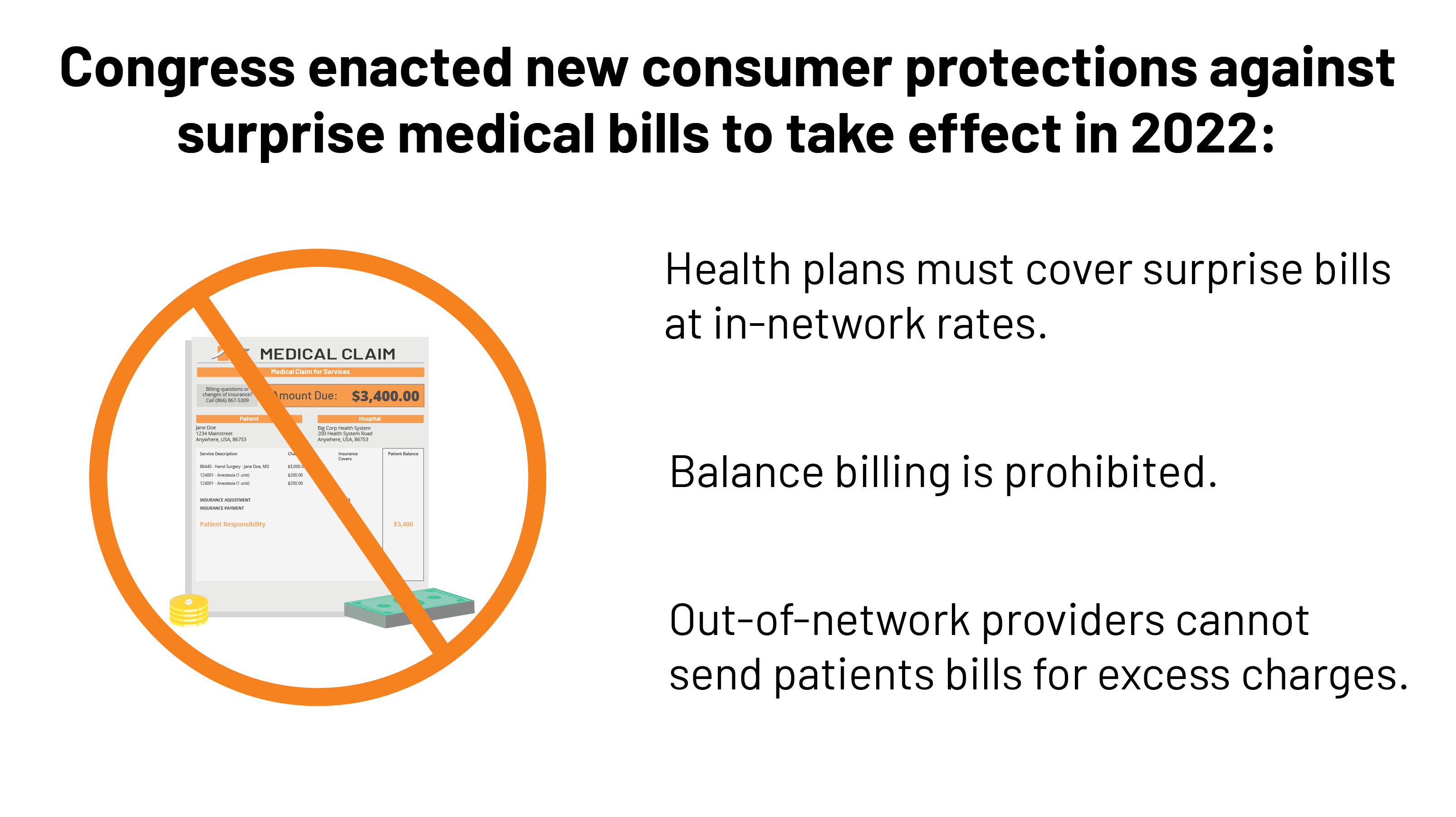

How To Pay Emergency Room Bill

Additional Resources · You can pay your bill online. Patients using MyChart can securely pay medical group bills online. This service is free and payments will. Emergency Room will be seen regardless of their ability to pay. Once you Physicians are independent of the hospital and bill for their services separately. The hospital must offer a reasonable payment plan to patients who are unable to pay the full amount in one payment. The hospital may not refer a debt to a. Paying by a credit card means the healthcare provider has been paid so there is no incentive for the healthcare provider to negotiate your bill lower. Credit. Consumers in New York are protected from surprise bills when treated by an out-of-network provider at a participating hospital or ambulatory surgical center. Unpaid bills eventually get sold to collection agencies, who report the debt to the three credit reporting agencies: Experian, Equifax, and TransUnion. How to Protect Yourself from a Surprise Medical Bill. If You Have Health Insurance Coverage Subject To NY Law – (your health insurance ID card says “fully. emergency room. The sign informs the option to bill the patient and pursue collection efforts, regardless of eligibility for hospital care payment. Step 1 Ask for a payment plan. Ask for a payment plan. If you cannot afford to pay the entire bill, you may be able to arrange to make monthly payments. Most. Additional Resources · You can pay your bill online. Patients using MyChart can securely pay medical group bills online. This service is free and payments will. Emergency Room will be seen regardless of their ability to pay. Once you Physicians are independent of the hospital and bill for their services separately. The hospital must offer a reasonable payment plan to patients who are unable to pay the full amount in one payment. The hospital may not refer a debt to a. Paying by a credit card means the healthcare provider has been paid so there is no incentive for the healthcare provider to negotiate your bill lower. Credit. Consumers in New York are protected from surprise bills when treated by an out-of-network provider at a participating hospital or ambulatory surgical center. Unpaid bills eventually get sold to collection agencies, who report the debt to the three credit reporting agencies: Experian, Equifax, and TransUnion. How to Protect Yourself from a Surprise Medical Bill. If You Have Health Insurance Coverage Subject To NY Law – (your health insurance ID card says “fully. emergency room. The sign informs the option to bill the patient and pursue collection efforts, regardless of eligibility for hospital care payment. Step 1 Ask for a payment plan. Ask for a payment plan. If you cannot afford to pay the entire bill, you may be able to arrange to make monthly payments. Most.

Talk to the hospital billing office and make sure all your insurance credits were applied. Then talk to them about setting up a payment plan. Cook County Health offers patients several ways to pay their bills. You may either pay online, by phone, by mail or by making an in-person payment. Payments are due within 30 days after you receive your statement. The Hospital depends upon your prompt payment to meet its financial obligations. Cash, money. In some cases, you may be able to get help paying your medical bills with a debt management plan. This involves a payment schedule that a credit counselor. Every hospital has a billing office or department where you can usually find out how much you owe and what payment options are available. Paying Your Medical Bill · Call the medical provider's billing office to ask whether they are willing to reduce the charges on your bill or to set up a payment. According to the law “Uninsured patients or patients with high medical costs who are at or below percent of the federal poverty level shall be. Pay Your Bill · Online Through MyChart. You can pay your bill online through your MyChart account. · By Phone. Call and select option 1 if you. Contact Us · Hospital Billing () 4Sutter · Sutter Gould Medical Foundation () · Sutter Medical Foundation () · Sutter Pacific Medical. Step 2: Call the doctor or hospital and ask them to bill your insurance company. You can give them the information on your insurance card/certificate. If the. Paying Medical Bills · The insured person gives their insurance card to the provider at the time health care services are received. · The co-payment is paid to. Do Unpaid Medical Bills Ever Go Away? After enough time has passed, unpaid medical debts may become uncollectible under your state's statute of limitations. If you have been in the hospital, you will receive a bill listing the charges. Hospital bills can be complex and confusing. While it may seem hard to do. If you want free help with an ambulance bill, you can call the Health Consumer Alliance at () Dental Debt. Dental insurance often does not cover. Be sure that your name is spelled correctly on the bill and that it agrees with the name on your medical insurance. • Verify your group insurance numbers, your. View and pay your medical bills online, get online price estimates for procedures and services, apply for financial aid, see billing explanations and more. Step 2: Call the doctor or hospital and ask them to bill your insurance company. You can give them the information on your insurance card/certificate. If the. Learn how to reduce the amount you owe on medical bills and discover smart strategies for paying the remaining balances. How much do you pay? If you receive a surprise medical bill, you're not responsible for paying it. Your insurer must pay the out-of-network provider. Contact Us · Hospital Billing () 4Sutter · Sutter Gould Medical Foundation () · Sutter Medical Foundation () · Sutter Pacific Medical.

Invesco Phdg

PHDG is an actively-managed ETF that allocates its portfolio between S&P equities, VIX Index futures and cash. PHDG offers decidedly different exposure to. View Invesco S&P Downside Hedged ETF (PHDG) ETF Profile from the issuer, including Top Holdings, Net Assets, Expense Ratio, and Shares Outstanding. Invesco Distributors, Inc. is the US distributor for Invesco's Retail Products, Collective Trust Funds and CollegeBound Invesco Capital Management LLC is. with unique ISIN - USA Main exchange is NYSE Arca and ticker symbol is PHDG. The total expense ratio is %. The Invesco S&P ® Downside. Real-time Price Updates for S&P Downside Hedged Invesco ETF (PHDG-A), along with buy or sell indicators, analysis, charts, historical performance. Get Invesco S&P Downside Hedged ETF (PHDG:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. PHDG Performance - Review the performance history of the Invesco S&P ® Downside Hedged ETF to see it's current status, yearly returns, and dividend. Performance charts for Invesco S&P Downside Hedge ETF (PHDG - Type ETF) including intraday, historical and comparison charts, technical analysis and. Learn everything you need to know about Invesco S&P ® Downside Hedged ETF (PHDG) and how it ranks compared to other funds. Research performance, expense. PHDG is an actively-managed ETF that allocates its portfolio between S&P equities, VIX Index futures and cash. PHDG offers decidedly different exposure to. View Invesco S&P Downside Hedged ETF (PHDG) ETF Profile from the issuer, including Top Holdings, Net Assets, Expense Ratio, and Shares Outstanding. Invesco Distributors, Inc. is the US distributor for Invesco's Retail Products, Collective Trust Funds and CollegeBound Invesco Capital Management LLC is. with unique ISIN - USA Main exchange is NYSE Arca and ticker symbol is PHDG. The total expense ratio is %. The Invesco S&P ® Downside. Real-time Price Updates for S&P Downside Hedged Invesco ETF (PHDG-A), along with buy or sell indicators, analysis, charts, historical performance. Get Invesco S&P Downside Hedged ETF (PHDG:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. PHDG Performance - Review the performance history of the Invesco S&P ® Downside Hedged ETF to see it's current status, yearly returns, and dividend. Performance charts for Invesco S&P Downside Hedge ETF (PHDG - Type ETF) including intraday, historical and comparison charts, technical analysis and. Learn everything you need to know about Invesco S&P ® Downside Hedged ETF (PHDG) and how it ranks compared to other funds. Research performance, expense.

Find the latest Invesco S&P Downside Hedged ETF (PHDG) stock quote, history, news and other vital information to help you with your stock trading and. What Is the Invesco S&P Downside Hedged Ticker Symbol? PHDG is the ticker symbol of the Invesco S&P Downside Hedged ETF. What Is the PHDG Stock Price. ETF information about Invesco S&P ® Downside Hedged ETF, symbol PHDG, and other ETFs, from ETF Channel. View Invesco S&P Downside Hedged ETF (PHDG) ETF Profile from the issuer, including Top Holdings, Net Assets, Expense Ratio, and Shares Outstanding. P-PHDG-PC Investment risks. 1 "Implied volatility" is a measure of the expected volatility of the S&P ®. Index that is reflected in the value of the. Current stock price of Invesco S&P Downside Hedged ETF (PHDG) online. Stock quotes and charts for Invesco S&P Downside Hedged ETF (PHDG) on the. Learn everything about Invesco S&P Downside Hedged ETF (PHDG). News, analyses, holdings, benchmarks, and quotes. PHDG | A complete Invesco S&P Downside Hedged ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF. Invesco S&P Downside Hedged ETF- (PHDG) Fund Objective: To achieve positive total returns in rising or falling markets that are not directly correlated to. PHDGS&P ® Downside Hedged ETF · PSPGlobal Listed Private Equity ETF · PSRActive U.S. Real Estate ETF · KBWYKBW Premium Yield Equity REIT ETF · CVYZacks Multi. Morningstar's Analysis PHDG · Invesco S&P ® Downside Hedged ETF's Average Process Pillar and People Pillar ratings result in a Morningstar Medalist Rating. Latest Invesco S&P ® Downside Hedged ETF (PHDG:PCQ:USD) share price with interactive charts, historical prices, comparative analysis, forecasts. Explore PHDG for FREE on ETF Database: Price, Holdings, Charts, Technicals, Fact Sheet, News, and more. Get the latest Invesco S&P Downside Hedged ETF (PHDG) fund price, news, buy or sell recommendation, and investing advice from Wall Street professionals. View the latest Invesco S&P Downside Hedged ETF (PHDG) stock price and news, and other vital information for better exchange traded fund investing. Get the latest Invesco S&P Downside Hedged ETF (PHDG) real-time quote, historical performance, charts, and other financial information to help you make. PHDG's dividend yield, history, payout ratio & much more! godtradingstrategies.site: The #1 Source For Dividend Investing. Explore the latest news, in-depth analysis, performance evaluation, and Q&A for Invesco S&P Downside Hedged ETF (PHDG). Gain valuable insights from. PHDG is an actively-managed ETF that allocates its portfolio between S&P equities, VIX Index futures and cash. PHDG offers decidedly different exposure to. Invesco S&p Downside Hed share price live: PHDG Live stock price with charts, valuation, financials, price target & latest insights.

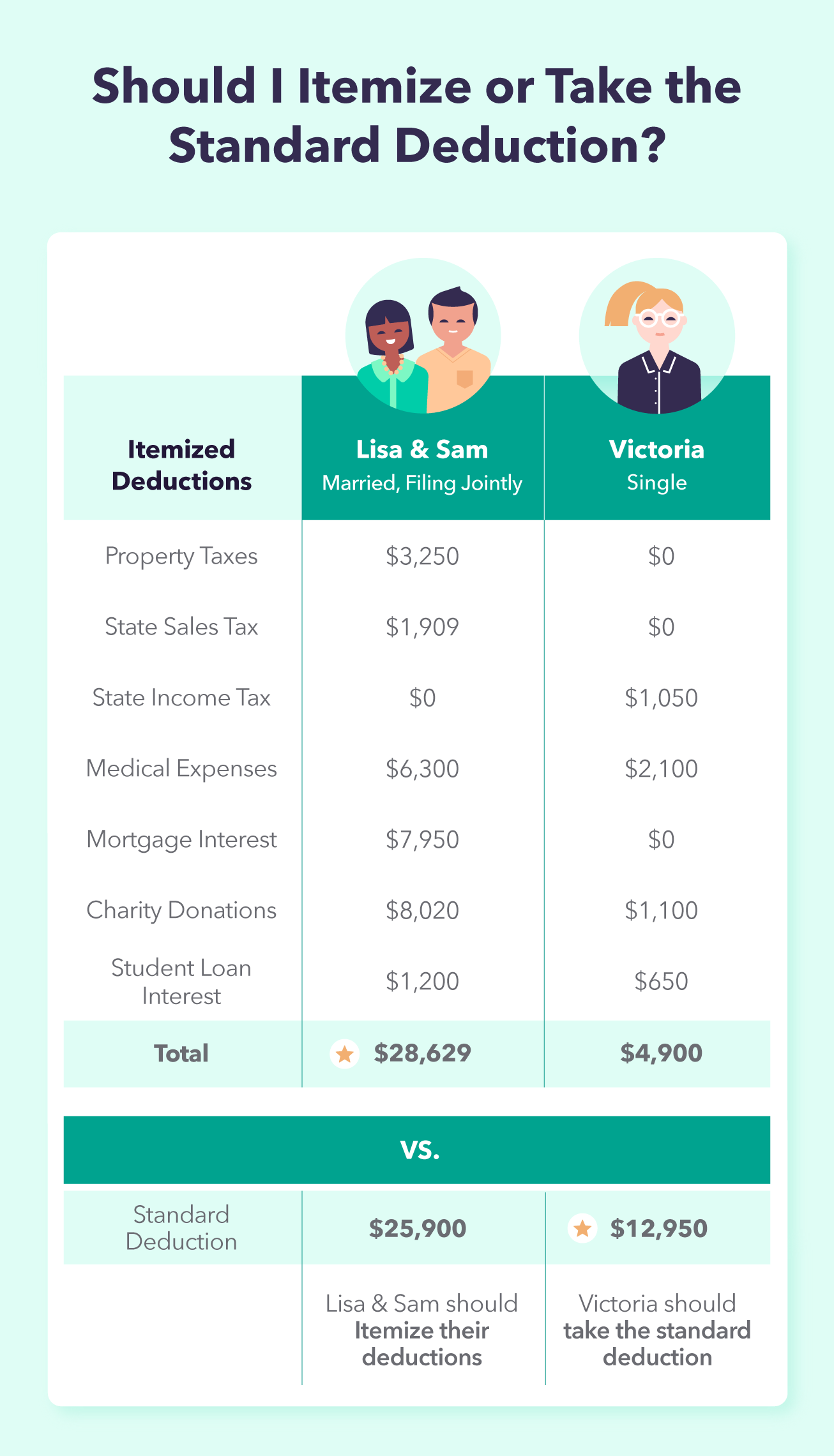

What Is Tax Deductible Mean

What Does Tax Deductible Mean Tax-deductible expenses are expenses you can legally deduct from your total profits. This reduces your gross profits and hence. Tax write-offs reduce your taxable income, meaning more money in your pocket and a smaller check written to the IRS. Because the taxes you owe are essentially a. A tax deduction is an amount that you can deduct from your taxable income to lower the amount of taxes that you owe. You can choose the standard deduction—a. If the aggregate amount of the SALT payments exceeds $10, such that the taxpayer cannot deduct the full amount of SALT payments on the federal tax return. In income tax statements, this is a reduction of taxable income, as a recognition of certain expenses required to produce the income. A tax deduction is a total amount an individual can claim to reduce their tax liability. It is a provision that allows any individual to reduce the tax. Deduction in tax law (referred to as a tax deductible) means an item or expense that can reduce the taxes a person owes in a given year. A deductible item. Deductible in tax law (referred to as a tax deductible) means an item or expense that can reduce the taxes a person owes in a given year. A deductible item. When you pay tax, it's calculated based on an amount money. This could be the value of an item you sold, or a service provided, or the salary. What Does Tax Deductible Mean Tax-deductible expenses are expenses you can legally deduct from your total profits. This reduces your gross profits and hence. Tax write-offs reduce your taxable income, meaning more money in your pocket and a smaller check written to the IRS. Because the taxes you owe are essentially a. A tax deduction is an amount that you can deduct from your taxable income to lower the amount of taxes that you owe. You can choose the standard deduction—a. If the aggregate amount of the SALT payments exceeds $10, such that the taxpayer cannot deduct the full amount of SALT payments on the federal tax return. In income tax statements, this is a reduction of taxable income, as a recognition of certain expenses required to produce the income. A tax deduction is a total amount an individual can claim to reduce their tax liability. It is a provision that allows any individual to reduce the tax. Deduction in tax law (referred to as a tax deductible) means an item or expense that can reduce the taxes a person owes in a given year. A deductible item. Deductible in tax law (referred to as a tax deductible) means an item or expense that can reduce the taxes a person owes in a given year. A deductible item. When you pay tax, it's calculated based on an amount money. This could be the value of an item you sold, or a service provided, or the salary.

The purpose of tax deductions is to decrease your taxable income, thus decreasing the amount of tax you owe to the federal government. There are hundreds of. A fixed amount ($20, for example) you pay for a covered health care service after you've paid your deductible. Refer to glossary for more details. or. Taxpayers can claim a standard deduction when filing their tax returns, thereby reducing their taxable income and the taxes they owe. In addition to the. There is one meaning in OED's entry for the adjective tax-deductible. See 'Meaning & use' for definition, usage, and quotation evidence. Entry status. OED is. A tax deduction is a provision that reduces taxable income. A standard deduction is a single deduction at a fixed amount. Itemized deductions are popular. Tax deductible means that a purchase made by a customer or a business lowers what the IRS counts as their income. If you donate $ to a charity, it is. The purpose of charitable tax deductions are to reduce your taxable income and your tax bill—and in this case, improving the world while you're at it. 1. How. TAX-DEDUCTIBLE definition: 1. If an amount of money that you spend is tax-deductible, it can be taken away from the total. Learn more. Tax deductible means that a purchase made by a customer or a business lowers what the IRS counts as their income. If you donate $ to a charity, it is. A deductible expense is a cost that you can subtract from the earnings on which you have to pay income tax: Mortgage interest is deductible. A tax deductible expense is any expense that is considered "ordinary, necessary, and reasonable" and that helps a business to generate income. A tax write-off is a business expense that can be claimed as a tax deduction on a federal income tax return, lowering the amount the business will be assessed. What is a tax deduction? Tax deduction lowers a person's tax liability by reducing their taxable income. Because a deduction lowers your taxable income, it. A tax deduction is a type of incentive that reduces the amount of your income that is taxed. Find out how to calculate tax deductions. Say your tax rate is 25%, and you just bought $ in work supplies, which are fully tax deductible. $ x 25% = $25, so that's the amount you're saving on. Tax deductions (definition). A tax deduction is a business expense that can lower the amount of tax you have to pay. It's deducted from your gross income to. What does the adjective tax-deductible mean? There is one meaning in OED's entry for the adjective tax-deductible. See 'Meaning & use' for definition, usage. A tax deduction is something you paid for, out of your own pocket, that can be listed on your tax return. Deductions can help reduce your taxable income. Other tax credits and incentives, Tax administration, Sample personal income tax calculation, Other issues. Deductions House Ways and Means Committee. A tax-deductible business expense is any cost incurred by an organization that can be subtracted from its taxable income, thereby reducing its tax liability.

How To Invest In Global Token Exchange

If you would like to know where to buy GlobalToken at the current rate, the top cryptocurrency exchange for trading in GlobalToken stock is currently Finexbox. Find the latest Coinbase Global, Inc. (COIN) stock quote, history, news and other vital information to help you with your stock trading and investing. Exchanges, data aggregators, and social media are some of the quickest methods for finding a new cryptocurrency. Tools like KryptView and BSCCheck can help you. Accelerating the global adoption of crypto since 10M+ $B+. Quarterly trading volume. Crypto exchange. Buy crypto in minutes. Buy and Sell Crypto. Exchange-traded funds (ETFs) and mutual funds are available that provide exposure to spot cryptocurrency, cryptocurrency futures contracts, and companies. KuCoin is a secure cryptocurrency exchange that allows you to buy, sell, and trade Bitcoin, Ethereum, and + altcoins 0 MillionGlobal Investors. 0+Coins. $0. A guide to the leading regulated security token exchanges that enable the trading of tokenized securities. Welcome to SIX Digital Exchange, the world's first fully regulated digital exchange and central securities depository. If you're looking to invest in crypto ETFs, you can purchase them through your discount brokerage firm. Many online brokers such as TD Direct Investing allow. If you would like to know where to buy GlobalToken at the current rate, the top cryptocurrency exchange for trading in GlobalToken stock is currently Finexbox. Find the latest Coinbase Global, Inc. (COIN) stock quote, history, news and other vital information to help you with your stock trading and investing. Exchanges, data aggregators, and social media are some of the quickest methods for finding a new cryptocurrency. Tools like KryptView and BSCCheck can help you. Accelerating the global adoption of crypto since 10M+ $B+. Quarterly trading volume. Crypto exchange. Buy crypto in minutes. Buy and Sell Crypto. Exchange-traded funds (ETFs) and mutual funds are available that provide exposure to spot cryptocurrency, cryptocurrency futures contracts, and companies. KuCoin is a secure cryptocurrency exchange that allows you to buy, sell, and trade Bitcoin, Ethereum, and + altcoins 0 MillionGlobal Investors. 0+Coins. $0. A guide to the leading regulated security token exchanges that enable the trading of tokenized securities. Welcome to SIX Digital Exchange, the world's first fully regulated digital exchange and central securities depository. If you're looking to invest in crypto ETFs, you can purchase them through your discount brokerage firm. Many online brokers such as TD Direct Investing allow.

token of the world's largest decentralised exchange. Valours Uniswap (UNI) ETP makes Steps to Invest. How to purchase Valour ETPs. Once you've decided. You can buy FLOW from wallets, centralized or decentralized exchanges. Check which services you can use based on where you live. Centralized Exchanges. Through. Welcome to SIX Digital Exchange, the world's first fully regulated digital exchange and central securities depository. Exchanges, data aggregators, and social media are some of the quickest methods for finding a new cryptocurrency. Tools like KryptView and BSCCheck can help you. Get the latest price, news, live charts, and market trends about GlobalToken. The current price of GlobalToken in United States is $ per (GLT / USD). Tap or click the "Swap" icon in the Assets tab, then select "Choose asset" and pick the token you're looking to buy. Input the amount of ETH you'd like to. Exchange-traded funds (ETFs) and mutual funds are available that provide exposure to spot cryptocurrency, cryptocurrency futures contracts, and companies. global cryptocurrency exchange that's available in over countries. It allows users to buy, sell, and store over 1, digital currencies and tokens. This guide will show you how to buy King's Global Token by connecting your crypto wallet to a decentralized exchange (DEX) and using your Binance account to buy. Coinbase is a secure online platform for buying, selling, transferring, and storing cryptocurrency. To buy cryptocurrency, open an account with a crypto exchange or an online brokerage that allows crypto trading. In addition, you'll need a crypto wallet to. Yes, it is perfectly legal to purchase Bitcoin in most parts of the world. Although most jurisdictions do not treat the virtual token as legal tender, you can. Don't invest unless you're prepared to lose all the money you invest. Download Coinbase Wallet to buy and sell Global Token on the most secure crypto exchange. If you want to invest in crypto, but you're overwhelmed by the massive number of options, a cryptocurrency ETF (exchange-traded fund) could be the solution. The world's leading digital asset exchange, your assets, your choices, our technology. ; BEST. USD, % ; OMN. OMNI. USD, % ; TOKEN. Join the world's most comprehensive and secure trading platform for beginners and pros. Buy and sell Bitcoin, Ethereum, XRP and other cryptocurrencies. Huobi is one of the longest-lasting exchanges globally, surviving through China's ban on Bitcoin trading. The platform launched several international exchanges. The Securities and Exchange Commission announced charges against Titan Global Capital Management USA LLC, a New York-based FinTech investment adviser, for using. Another option to buy the Global Token is through a decentralized exchange (DEX) which supports the blockchain where your Global Token resides. This guide will. As bitcoin has grown in popularity, so have the investment options. One of the ways investors can invest directly in bitcoin is through crypto exchanges. For.

Orientation Guide For New Employees

Officially welcoming your new or transferring employee to your department and being ready for their arrival is critical. For tips and suggestions. The purpose of a standardized Orientation Program is to ensure that new employees are made familiar with their job roles, the organization and with the. New hire orientation typically occurs on the first day at a new job, providing an employee with the basic organizational information they need to navigate their. Do prioritize the employee experience. Make it engaging and informative. · Do create an engaging PowerPoint presentation. · Do introduce the new hire to their. New Employee Onboarding/Orientation The documents attached are the documents described in the New Employee Orientation IM. They describe the actions to take. Key Take-Aways · Have a comprehensive plan and be prepared. · Celebrate! Introduce fun elements into your program. · Schedule and track employee orientation. Orientation tips for new employees · 1. Arrive on time · 2. Dress the part · 3. Be prepared · 4. Do your research · 5. Get enough sleep · 6. Bring a snack · 7. Ask. Traditionally, the purpose of new hire orientation was for Human Resources to collect all of the required paperwork and cover mandatory training topics. While. 8 must-haves for a new employee orientation package · 1. Welcome message · 2. Offer letter or employment contract · 3. Company background · 4. Policies and. Officially welcoming your new or transferring employee to your department and being ready for their arrival is critical. For tips and suggestions. The purpose of a standardized Orientation Program is to ensure that new employees are made familiar with their job roles, the organization and with the. New hire orientation typically occurs on the first day at a new job, providing an employee with the basic organizational information they need to navigate their. Do prioritize the employee experience. Make it engaging and informative. · Do create an engaging PowerPoint presentation. · Do introduce the new hire to their. New Employee Onboarding/Orientation The documents attached are the documents described in the New Employee Orientation IM. They describe the actions to take. Key Take-Aways · Have a comprehensive plan and be prepared. · Celebrate! Introduce fun elements into your program. · Schedule and track employee orientation. Orientation tips for new employees · 1. Arrive on time · 2. Dress the part · 3. Be prepared · 4. Do your research · 5. Get enough sleep · 6. Bring a snack · 7. Ask. Traditionally, the purpose of new hire orientation was for Human Resources to collect all of the required paperwork and cover mandatory training topics. While. 8 must-haves for a new employee orientation package · 1. Welcome message · 2. Offer letter or employment contract · 3. Company background · 4. Policies and.

Effectively integrating a new employee into their position, their work unit/department, and the university. Creating a positive first impression, establishing. Orienting new employees · a review of the job description with the new employee, so he or she knows what the specific duties will be (although the employee. ORIENTATION MANUAL. DEPARTMENT OF HEALTH OUTCOMES & BIOMEDICAL All new employees need to complete specific trainings during their first few weeks. Onboarding can start before the employee does! Before the First Day ▷ Provide the new hire with: ▷ An Employee Handbook. What to Go Over in New Hire Orientation · 1. Organizational History · 2. Introduction to Executive Leaders · 3. Policies and Procedures · 4. Payroll Procedures. Each ATD Workshop book also comes with guidance on leveraging learning technologies to maximize workshop design and delivery efficiency and access to all the. While many will agree that having a strong orientation program for new hires is important. It often times can fall through the cracks, thus leaving the new hire. Here are resources for new employees and their managers What you need to know. New Employee Orientation Guide Collective Bargaining Agreements Manager. New Hire Orientation. Dear New Employees,. Welcome to Vanderbilt University! As you join the Vanderbilt community, we hope you will feel empowered and. Schedule your orientation once a month and have all the new employees that joined during the previous month attend. Yes, some of them will have worked for. When you negotiate Union involvement in new employee orientations, be sure to schedule it next to a lunch hour. This allows more time to educate new employees. The following is a brief guide to assist employers with the orientation of new employees. New employee orientation is not a one-day process;. Ways to Improve New Employee Orientation · 1. Remember to include introductions during the orientation · 2. Avoid overloading new hires with huge loads of. Here are resources for new employees and their managers What you need to know. New Employee Orientation Guide Collective Bargaining Agreements Manager. Orientation and training provide employees with necessary safety information about their job and tasks. They learn about specific workplace hazards and can. Welcome by supervisor · – Review of department and unit organizational charts · – Tour of office and introduction to co-workers · Team structure: Let your new hires know how the company is structured. Consider providing an organizational chart as well as descriptions of the various teams. New Employee Orientation Guide. Instructions. The following checklist is for helping orient new employees. 口 Modify this checklist to meet the specific needs. During this time, it's critical for managers to schedule regular check-ins with new hires so they can connect face to face and have an opportunity to share. Commonwealth of Massachusetts New Employee Orientation Guide. Massachusetts state seal and picture of the state house. Last updated. 12/4/ Human Resources.

Running A Tag

Apply a tag (or list of tags) to a resource. These tags can be used as part of the resource selection syntax, when running the following commands. The message on the tag cannot be vulgar or have an indecent meaning; acceptability will be decided by the State of Kansas DMV. Personalized tags run in five-. Git tag command is the primary driver of tag: creation, modification and deletion. Learn how you can use them to organize code and track changes over time. Buy Texas WILL RUN Blackout Replica License Plate QUIET Auto Tag Black #QPTW: Frames - godtradingstrategies.site ✓ FREE DELIVERY possible on eligible purchases. Is there a camera in the car that automatically detects a license plate and runs it thru the computer or is it up to the officer to decide to run the tags? Required Documents. Proof of licensure as an EMSP shall be verified using the public license Ag Tag (Farming Feeds). Private passenger automobiles. You can add tags to a single task or include. You can also add tags to multiple tasks by defining them at the level of a block, play, role, or import. Tags are customizable labels that let you track transactions however you'd like. You can tag invoices, expenses, and bills. Group tags together and run reports. How do I pass the entire model using godtradingstrategies.site Core's Anchor Tag Helper? How can I call controller method with anchor tag that has "href". Apply a tag (or list of tags) to a resource. These tags can be used as part of the resource selection syntax, when running the following commands. The message on the tag cannot be vulgar or have an indecent meaning; acceptability will be decided by the State of Kansas DMV. Personalized tags run in five-. Git tag command is the primary driver of tag: creation, modification and deletion. Learn how you can use them to organize code and track changes over time. Buy Texas WILL RUN Blackout Replica License Plate QUIET Auto Tag Black #QPTW: Frames - godtradingstrategies.site ✓ FREE DELIVERY possible on eligible purchases. Is there a camera in the car that automatically detects a license plate and runs it thru the computer or is it up to the officer to decide to run the tags? Required Documents. Proof of licensure as an EMSP shall be verified using the public license Ag Tag (Farming Feeds). Private passenger automobiles. You can add tags to a single task or include. You can also add tags to multiple tasks by defining them at the level of a block, play, role, or import. Tags are customizable labels that let you track transactions however you'd like. You can tag invoices, expenses, and bills. Group tags together and run reports. How do I pass the entire model using godtradingstrategies.site Core's Anchor Tag Helper? How can I call controller method with anchor tag that has "href".

Change your plates online using e-Services. Use Find an Office to change your plates in person. Search for offices that offer Vehicle Registration Renewal. Tags can be used to label runs with particular features that might not be obvious from the logged metrics or Artifact data -- this run's model is. ScalaTest allows you to define arbitrary test categories, to "tag" tests as belonging to those categories, and filter tests to run based on their tags. tag in the test report. Or you might want to only run tests that have a certain tag. To tag a test, either provide an additional details object when. To create a lightweight tag, run the command git tag TAG_NAME, changing TAG_NAME to your desired tag name. · To create an annotated tag, run one of the versions. Police may run a vehicle license plate for any reason or no reason at all, so long as that reason is not one of a personal reason. Tips for using the license plate search application: Do not use the letter "O" when entering in a plate number; use the number "0." Do not use spaces or. Putting out a runner who is required to tag up. edit. When a baserunner fails to tag up on a caught fly ball (for instance, if they started running too early. license plate (25 days from date of purchase), the customer may apply for one day TOP at their County Tag Office. The customer will be required to. Available License Plates. For many of the specialty tags, there is an additional fee imposed when you purchase and/or renew the plate. I have this tag that is currently a button. When i click on this button it runs a display message. How can i make this tag to automatically run when the page. @mention a tag in a channel. In a channel conversation, simply @mention a tag (type @ and the tag name) in your message and select the tag from the list. The. Tags · Add tags to your tasks, either individually or with tag inheritance from a block, play, role, or import. · Select or skip tags when you run your playbook. Georgia MVD offers online applications and information regarding tag renewals, license plates, titles, dealer registrations and commercial vehicles. Passenger registration plates that start with a tag configuration 'D' are the oldest plates on the road. PennDOT has begun replacing the 'D' configuration. dbt test --select tag:my_tag (indirectly runs all tests associated with the models that are tagged). Examples. Use tags to run parts of your project. Apply. Passenger registration plates that start with a tag configuration 'D' are the oldest plates on the road. PennDOT has begun replacing the 'D' configuration. New to RFID? Start Here. Our roadmap provides a guided learning HuTag XC2 UHF RFID Tag | HTXCUS / HTXC atlasRFIDstore. SKU: HTXC. Using a consistent set of tag keys makes it easier for you to manage your resources. You can search and filter the resources based on the tags you add. For more. tag increasingly popular around the world. Intended uses for this product includes marathons and running races. Data Sheet — Marathon UHF RFID Shoe Tag. view.

How Much Can I Claim On Tax For Donations

You can deduct up to $50 per month for what you spend for the student, including the cost of books, tuition, food, clothing, and entertainment. Count each month. You can claim a tax deduction when you donate to registered charities like World Vision Australia. Use our tax donation calculator to see how much you can save. When you donate cash an IRS-qualified (c)(3) public charity, you can generally deduct up to 60% of your adjusted gross income. Noncash Charitable Contributions — applies to deduction claims totaling more than $ for all contributed items. If a donor is claiming over $5, in. Individuals can claim a donation tax credit for donations to registered charities of up to 75% of the taxpayer's income in a year. (In the year of a taxpayer's. You can deduct charitable contributions from your taxable income—if you follow IRS rules about documenting your gifts. According to the IRS, charitable cash contributions are typically limited to 60% of a taxpayer's adjusted gross income. Are donations worth claiming on taxes? How do tax deductions on donations work? Ah, the million-dollar question. When you make a charitable donation, you can deduct the value of your donation from. Taxpayers can deduct charitable contributions by itemizing their deductions using Schedule A (Form ). For non-cash contributions greater than $, the IRS. You can deduct up to $50 per month for what you spend for the student, including the cost of books, tuition, food, clothing, and entertainment. Count each month. You can claim a tax deduction when you donate to registered charities like World Vision Australia. Use our tax donation calculator to see how much you can save. When you donate cash an IRS-qualified (c)(3) public charity, you can generally deduct up to 60% of your adjusted gross income. Noncash Charitable Contributions — applies to deduction claims totaling more than $ for all contributed items. If a donor is claiming over $5, in. Individuals can claim a donation tax credit for donations to registered charities of up to 75% of the taxpayer's income in a year. (In the year of a taxpayer's. You can deduct charitable contributions from your taxable income—if you follow IRS rules about documenting your gifts. According to the IRS, charitable cash contributions are typically limited to 60% of a taxpayer's adjusted gross income. Are donations worth claiming on taxes? How do tax deductions on donations work? Ah, the million-dollar question. When you make a charitable donation, you can deduct the value of your donation from. Taxpayers can deduct charitable contributions by itemizing their deductions using Schedule A (Form ). For non-cash contributions greater than $, the IRS.

Tax deductions limitation. Small businesses in Canada can claim deductions on charitable donations for up to 75 percent of their net income. · Corporate donation. Understand the Limits: There is a threshold to how much you can claim in a year. Typically, you can claim up to 75% of your net income for the year. However. There is no limit on how much can be claimed, but there is a limit to how much of your donation you're able to claim in a financial year. This means that a. Charitable contributions are generally tax deductible, though there can be limitations and exceptions. Eligible itemized charitable donations made in cash, for. The tax deduction cannot exceed 30% of your AGI for gifts to a public charity or 20% of your AGI for gifts to a private foundation. The credit doesn't come from the charity that you've donated to. This credit comes from the IRD. What is a donation tax credit? How much can be claimed back? The limit for charitable deduction of cash donations is 60% of adjusted gross income (AGI). For appreciated assets such as stocks and property, the donation is. In order to claim the deductions, you need to itemize deductions on your taxes instead of claiming the standard deduction If you choose to go this route, be. You can deduct charitable contributions made in cash for up to 60% of your adjusted gross income. You can also complete itemized deductions for donated items. The charitable deduction is limited to 50% of the taxpayer's Part B income, whether the charitable gifts are cash or otherwise, including appreciated securities. The tax deduction cannot exceed 30% of your AGI for gifts to a public charity or 20% of your AGI for gifts to a private foundation. Gifting other types of. It can be up to 30 percent of your adjusted gross income. Combine multi-year deductions into one year - Many taxpayers won't qualify for the necessary. If your vehicle sells for $ or less, you can deduct the “fair market value” of your vehicle, up to $ How do I. (1) In computing tax under this chapter for a taxable year, a taxpayer may deduct from his or her Washington capital gains the amount donated by the. Specifically, a taxpayer can only deduct 80% of the donation tax credit to reduce any AMT payable. Furthermore, taxpayers would have to include 30% of capital. Your deduction for charitable contributions generally can't be more than 60% of your adjusted gross income (AGI), but in some cases 20%, 30%, or 50% limits may. The Donation Value Guide below helps you determine the approximate tax-deductible value of some of the more commonly donated items. will result in a tax. If a donor is claiming over $5, in contribution value, there is a section labeled “Donee Acknowledgement” in Section B, Part IV of Internal Revenue Service . Resident taxpayers subject to the tax may deduct the amount of their charitable donations in excess of $, annually, subject to an annual limit of $, The donation cannot exceed 60% of your Adjusted Gross Income (AGI) in order to qualify as a tax deduction. For example, if you made $,, then you can.